Why do we engage in this?—The ultimate question surrounding “impact investing”

In fall 2023, Keio Innovation Initiative (KII) established its first impact investment fund.

Change the future by achieving both social impact and profitability. This is a cutting-edge investment method that has not yet been established in Japan.

How should we attempt to carve out an unprecedented path? Advisors were invited to take the lead in putting this into practice.

While working on the front lines of impact investing in the United States, Nao Sudo focuses on environmental improvement and dissemination activities in Japan.

Why and for whom are you working? What clues emerged during the dialogue that questioned the essence?

We will unravel the thoughts on impact from the words of advisor Nao Sudo and KII President Kotaro Yamagishi.

Each person’s intention to engage in “impact investing”

Yamagishi:I learned about Ms. Sudo after reading “Introduction to Impact Investing” published in 2021. The reality is that there are still very few methodologies and practical examples of impact investing in Japan. As I continued to read his book, I gained a deeper understanding of it and realized the hurdles of engaging in impact investing from the seed/early stage in the deep tech field that we target. Since there is no precedent for this in Japan, we wanted Ms. Sudo, who has a global perspective and knowledge of the latest situation, to be involved as an advisor, so we contacted her.

Sudo:While I was involved in research and advocacy at Impact Frontiers, a foundation that promotes the spread of impact investing in the United States, I personally wanted to contribute to improving the environment in Japan, so I am very grateful for this opportunity. thought.

In fact, in Japan, we participate in the domestic advisory committee of the global impact investment promotion network GSG (The Global Steering Group for Impact Investment), and we pick up overseas information related to impact investing and provide summaries and explanations. I have been involved in activities such as the newsletter “ImpactShare,” but KII’s efforts left a new impression on me.

Specifically, I saw an announcement that asset owners Japan Post Insurance and Keio University will collaborate and cooperate with each other mainly in the impact investment field, and work together to solve social issues and create innovation. I thought it was a wonderful initiative in which funders and managers came together to support startups. Furthermore, I sympathized with the vision of “changing society with the knowledge of academia” and wanted to contribute.

Yamagishi:When it comes to impact investing, Ms. Sudo is well-versed in both the perspective of leading to solutions to social issues and the knowledge related to finance. We also felt the need to delve into a wide range of financial knowledge, not just impact investing. Even so, I remember thinking that I was very grateful to be able to request monthly meetings from September 2022. We have been able to spend a lot of time together, connecting Japan and the United States and conducting the event online.

Sudo:Well, I remember the first time very well. There were a lot of questions asked from the start, and I thought the session was extremely dense and fast-paced. We received questions in advance, thought of comments, and sent reference materials after the meeting…I could really feel everyone’s enthusiasm.

For example, when introducing “IMM (Impact Measurement & Management)” *1, IMM is just a tool, and the question is “what does it do?” As you pursue IMM, you will run into the wall of change management within your organization. Changes in systems and awareness are required among the people involved, and in order to gain the understanding and sympathy of investors, everyone from the top to the person in charge must be motivated. In this respect, I felt that KII had the commitment of its top management to overcome various hurdles, as well as the strong will and enthusiasm of its members.

Every day we face the proposition of “changing society” without a textbook.

——Since its establishment in 2015, KII has aimed to implement academia’s knowledge into society and help solve problems. I think the fact that we had an awareness of impact investing from the beginning is a big advantage.

Yamagishi:That’s true in terms of a sense of purpose. However, when implementing impact investing, it is necessary to clearly present to investors how the startup they are investing in can contribute to society and how much growth potential it has, so that they understand. That is why it is necessary to introduce protocols such as IMM as a tool to explain how social impact and financial returns can coexist, and then disseminate accurate information. That’s what I realized through talking with Ms. Sudo.

Sudo:Even if we say we aim to solve social issues through business, how do we put it into words and connect it to common understanding? Furthermore, how will this lead to benefits for end stakeholders? First of all, the capitalists involved must understand and be able to express themselves.

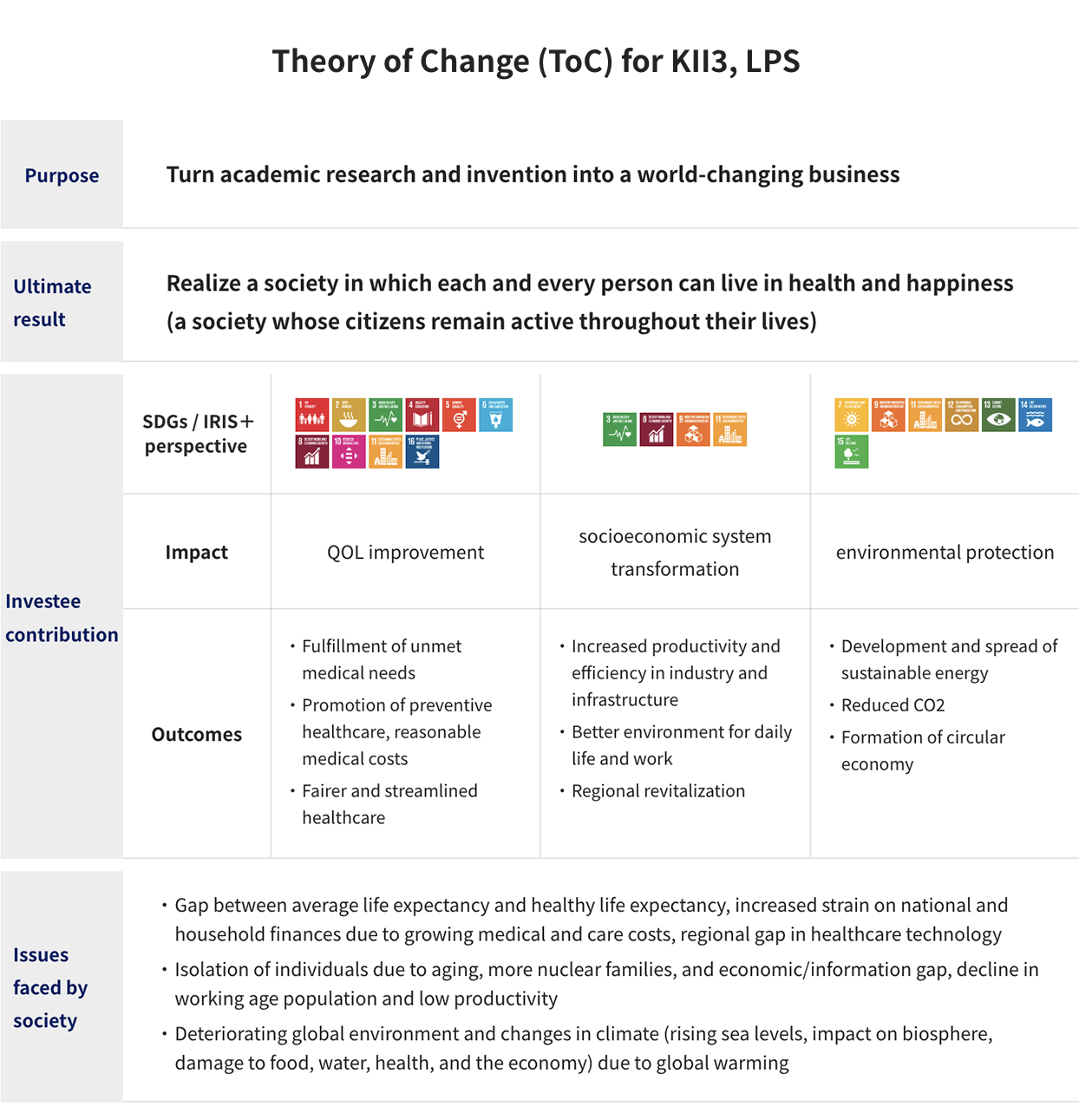

By the way, when I received the request to formulate a Theory of Change (ToC) *2 at the first meeting, I looked at the KII website and realized that the philosophy was already expressed as a mission statement. thought. If that’s the case, I thought that what I could do was help everyone at KII refine what they were trying to figure out in advance and raise the resolution.

Yamagishi:You mean the mission statement that was formulated when the second fund was established: “Until the research, the invention, and the innovation change society.” As you said, it is true that we have made an effort to think in our own way. However, when it came to forming KII3, LPS, I was having trouble deciding whether this was the right thing to do…so I ended up consulting with Ms. Sudo every time.

Sudo:For me, I also tried to dig deeper into the point of view while making various points. “What is this outcome?” “The logic here isn’t connected, right?” and “What kind of impact do we want to create as KII?”

My experience is that many people in Asia, including Japan, want a textbook answer that says, “If you do this, you’ll be fine.” First and foremost, I try to say, “There is no right answer.” Although there are methodologies to refer to and certain items to consider, each company needs to consider how to apply and implement them in light of its fund strategy.

——KII3, LPS was established this October. What kind of response do you feel at this point?

Yamagishi:Up until now, we have been making preparations with Ms. Sudo as our escort, but the question is finally, “How are we going to do it?” It’s a heart-warming feeling.

Sudo:The reality is that there are still very few domestic examples of initiatives in this area, and almost all reference materials are in English. For that reason, I believe that the implementation of KII can be called the forefront of Japan. Moreover, I can only give you the basic idea. How everyone implements this and how they create impact…I am very interested and find it very rewarding.

Questioning ourselves and carving out an unprecedented path for the future

——Please tell us about your goals and vision for the collaboration between KII and Sudo from here on.

Yamagishi:We have just entered the operational phase of our impact investment fund, and the real work is about to begin. How do we communicate and get people to understand what impact investing can do? We must carefully work on this, including disseminating information, while increasing the literacy of each and every capitalist. The story of how to solve problems differs depending on the target business or area, and the steps cannot be standardized, so we believe that we have no choice but to tackle each issue one by one.

Sudo:I think this is where a capitalist can show off their skills and should not be neglected. However, I think everyone at KII has already reached the depth of IMM discussions. I look forward to seeing how they pursue this depth and put it into practice.

In the first place, there is no fixed answer to the question “How do we change society?” That’s why we must always keep asking ourselves, “Why do we do impact investing?” The recipients of financial returns are shareholders, but the recipients of impact returns are the earth and people. This requires a major shift in thinking from an approach that focuses only on shareholders.

On top of that, institutional investors who pursue impact constantly ask themselves whether their actions are having a positive impact on the future of the earth and society. We also share learnings beyond organizational boundaries and encourage each other to improve. Whether you’re an investor or an entrepreneur, I think it’s important to continue thinking together, regardless of your position.

Yamagish:On that point, KII is staffed with motivated capitalists who have chosen the highly difficult job of working on deep tech startups from the seed/early stage. Our strength may be our desire to create a system that is profitable and sustainable in order to change society, rather than just pursuing financial returns.

Sudo:I think so. I also wanted to get a job where I could contribute to the world, so when I got involved with Impact Investment Exchange Asia (a Singapore-based platform that connects entrepreneurs and investors working to solve social issues), I realized that traditional capital I became interested in impact investing after I realized that there were needs and issues that could not be met by the market.

It gives me great pleasure to work with people who pursue change for a better society through investment.

Yamagishi:For us as well, this is a challenge that requires us to question the meaning of our existence, and requires a perspective that goes beyond the conventional framework and a large-scale cooperative system. For that reason, it is truly reassuring to be able to work with Ms. Sudo. Thank you for your continued support.

Sudo: Thank you. What is needed for the impact investment industry to expand is the presence of institutional investors with diverse risk preferences. Looking at the situation in the United States, I feel that there is an extremely diverse range of entrants, from foundations to funds that emphasize financial returns. On the other hand, in Japan, new entrants have only just begun. That is why it is so important for practitioners to share their challenges and learnings with each other. I hope that KII will not only accumulate knowledge within the company through practice, but also play an active role as a leader in the industry. I would like to contribute in whatever small way I can, so please continue to support us.

A series of processes that involves identifying, managing, and reporting impacts, and utilizing this cycle for improvement in order to measure the social effects of impact investing.

Source: Nao Sudo, “Introduction to Impact Investing”, Nihon Keizai Shimbun Publishing, 2021.

A comprehensive overview of how and why expected changes will occur.

Source: Theory of Change Japan

http://www.theoryofchange.jp/whatistoc