Bringing transformation through KII3, LPS and impact investing

The Keio Innovation Initiative (KII) was established in 2015 in order to incorporate into society the results of research undertaken by Keio University.

KII subsequently expanded the scope of its investments beyond Keio University, and the total amount of these investments has now reached approximately ¥15 billion through steady growth.

Now, in 2023, KII will begin impact investing through its new, KII3, LPS.

This is a frontline initiative with the aim of achieving both an impact on society and profitability, and changing the future. Kotaro Yamagishi, CEO of KII, has the following to say about the mission of KII as it enters a new phase, and the driving force that leads to transformation.

A passion for combining the results of university research with social impact

– Keio Innovation Initiative (KII) was established in 2015 by Keio University as a venture capital company.Please tell us about its goals and background.

Yamagishi:Investing in and nurturing startups that work to incorporate the results of research undertaken by Keio University as well as by other universities and broadly contributing to the development of society is the unchanging goal and social mission that KII has had since its establishment.

With the aim of leveraging academic knowledge to provide solutions for issues faced by society, we manage funds to support commercialization while also aiming to put in place economically sustainable mechanisms. One of the spurs for its establishment was my desire to give something to the next generation in the same way that my teachers and seniors from my time at Keio University helped me out when I co-founded GREE. And this just happened to be right at the time that Keio University was considering establishing a venture capital company, and it ended up with the establishment of a venture capital company by the university.

– You then went on to steadily broaden the company’s activities through initiatives such as expanding its scope of investment beyond Keio University.

Yamagishi:Yes. Keio Innovation Initiative 1,LPS, which was established in 2016, focused on startups working to commercialize the results of research undertaken by Keio University. It has reached ¥4.5 billion, which exceeded its target. Investments have been made in 19 companies, of which three have achieved an IPO.

Driven by the favorable market conditions for startups launched by universities, KII2, LPS that was subsequently established in 2020 had an expanded scope that also included universities other than Keio University and research institutes. This fund has also exceeded its target and reached ¥10.3 billion, with investments in 27 companies at present. Over the past few years, the environment surrounding startups launched by universities has undergone significant changes.

An increase in the power of computational technology has led to the wave of innovation advancing from the field of IT into life science fields including medicine and science and engineering, and there has been increased momentum toward leveraging academic knowledge to find solutions to issues faced by society.

While an awareness of starting businesses has taken root among researchers, the level of startups now feels significantly higher than it used to be due to the participation of professionals in management. With our track record and know-how from Keio Innovation Initiative 1,LPS and KII2, LPS as well as increasing expectations from investors, KII has made the decision to establish KII3, LPS.

– At ¥20 billion (*confirmation pending*), KII3, LPS greatly exceeds the scale of the other funds established so far and will be put together as an impact investing fund. In specific terms, what kind of fund is it?

Yamagishi:What is generally considered to make impact investing unique is that it produces a beneficial impact in terms of society or the environment while simultaneously producing financial returns. In this respect, it represents no great change in KII’s approach to investment, which, since its founding, has always been social contribution that leverages academic knowledge.

We see it as merely an extension of the initiatives that we have taken so far. However, in impact investing, you have to measure and visualize the impact that a business has on society and the environment in a clear way. Given that evaluation in line with a rigid framework is required, at KII we have put together a “Theory of Change” (ToC)*1 as a framework approach to solution-oriented businesses, and we have introduced a methodology for strategy design and implementation that follows a logic model called IMM (impact measurement and management).*2Investment strategy verbalization and information disclosure are deemed to be more important than ever, and will be subject to rigorous evaluation.

The significance of being a forerunner in impact investing

– So, against a backdrop of increasing expectations from society on solution-oriented solving businesses, you mean there are now standards to be complied with as the basis for evaluating impact.

Yamagishi:Impact investing is advocated as a way to reach solutions for problems faced by society and has developed as a new investment technique. Evaluation indicators are also currently being discussed, and we are also involved in rule making.

And while the scope of impact investing is very broad, investments are generally in businesses that are already established. In contrast, we have always included the field of deep tech in the scope of our support.

What this refers to is startups that are anticipated to provide solutions for issues faced by society based on new scientific knowledge and innovative technology, and they are characterized by the large magnitude of their expected impact and the high level of difficulty in achieving this. Given that we attempt to work with and support startups from the seed and early stages, the way we disseminate information is different from cases where commercialization of a certain size is expected in one or two years. In order to ensure that the future potential of a business and that its long-term value is correctly appreciated by society, we have to make efforts to create a framework.

– As a venture capital company that provides support for startups originating in academia, you are leading the way in involvement in impact investing, but is there anything that you are making particular efforts toward in aspects such as your structure?

Yamagishi:Ahead of the establishment of KII3, LPS, we re-examined the aims of our activities and our purpose, and again worked on verbalization.

The foundation for this was the mission statement that we formulated upon the establishment of the second fund: “Let us help your research, your invention, your innovation change the world.” The goal of an investment is not for an investee to achieve an IPO; we want to work with entrepreneurs to create the societal transformation that comes after this. And from this mission, what we have identified this time is the purpose of KII.

“Turn academic research and invention into a world-changing business.”

What we incorporated into this single sentence is a fundamental question about our originality that sets us apart from other venture capitalists and where it lies. Firstly, it lies in our approach of linking the knowledge of academia to social contribution. There is also a sense of purpose to change our own future by having this take root as an industry. This sentence is a clear manifestation of this passion.

Furthermore, as an aspect of creating our Theory of Change (ToC), we also defined the “ultimate results” that we have to aim for. “Realize a society in which each and every person can live in health and happiness (a society whose citizens remain active throughout their lives).” With this goal, we will work to create impact in the three areas of QOL improvement, socioeconomic system transformation, and environmental protection.

– Tell us in detail about the three impacts you just mentioned.

Yamagishi:Let me give you a typical example of each. Firstly, QOL improvement initiatives include working to increase quality of life and wellbeing for people through the establishment of new methods of treatment and the further promotion of preventive healthcare. In socioeconomic system transformation, we will aim to provide solutions for the declining workforce resulting from Japan’s severely declining birth rate and aging population through industrial application of a range of technologies, such as robotics, IT, and AI. For environmental protection, examples include the development and promotion of sustainable energy and the realization of a circular economy.

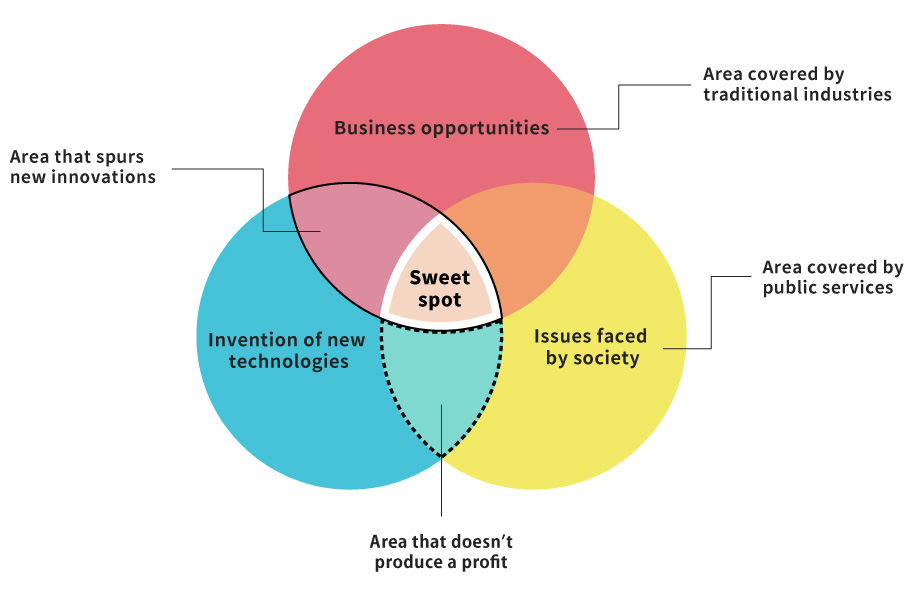

In any case, the important thing is to take the approach of clearly setting out whose and what kind of problem it is, and how you will solve it. This is because the fields that we are working in still have no solutions and are deemed to have commercialization potential (see the diagram below). On this basis, what I believe is more important than anything else is an approach of going beyond the scope that one might associate with the word “investment” and getting involved in business planning and team building, considering things together, and changing thinking.

A grand vision for transcending organizational boundaries and bringing about transformation

– Since 2019, you have been director of the Japan Venture Capital Association (JVCA), and you took up the position of managing director this summer. The approach of going beyond the boundaries of a single company and contributing to the future of society as a whole nurtures a unique corporate ethos, and it seems this applies to the KII team members too.

Yamagishi:Being involved with this work, there is something that I feel is very important: the relationship between venture capital companies is not one where they inevitably compete against each other, but where they guide society together through investment. When venture capital companies join hands to transcend university and organizational boundaries and join forces to create a startup, this is when they can change the world. And to this end, I myself intend to do my utmost.

In terms of team members as well, we have a group of venture capitalists who are interested in complex and important fields, and who want to have an impact on society. Furthermore, for KII3, LPS we have signed an advisory agreement with Nao Sudo, who serves as director of the Impact Frontiers, an organization that works to promote impact investing in the US. My hope is that this will allow us to stay abreast of the latest global trends in impact investing and lead to a highly effective investment strategy.

– With the establishment of KII3, LPS, your approach and mindset toward social contribution became very apparent. How do you see things going forward now?

Yamagishi:With an unchanging awareness of the aims KII has had since its founding, I think the number of people involved and the scale of KII will grow, and our relationships will become even deeper.

Among those who support us in the establishment of KII3, LPS, Japan Post Insurance is a very eager institutional investor when it comes to bringing transformation to society through impact investing, and is a very reassuring presence for us. Our ties to Keio University will also become even stronger. I myself was appointed Vice-President of Keio University in 2021, and I am currently involved in the activities of the Startup Division that has been established in the University’s Office of Innovation and Entrepreneurship.

This enhancement of funding and structure will enable support that is more granular and on a greater scale. Inquiries from other universities and research institutes are also increasing, and I expect that we will enjoy an even broader range of opportunities for transcending the boundaries between organizations and fields to identify and nurture new seeds.Furthermore, I think it will be great if our initiatives provide precedents in the field of impact investing, resulting in an increase in the momentum for social transformation among other venture capital companies and investors.

And that’s why we to further deepen our knowledge and know-how and grow as a team.I intend to work as hard as I can to deliver as much impact as possible to society.

This refers to a comprehensive description and illustration of how and why a desired change is expected to happen.

Source: Theory of Change Japan

http://www.theoryofchange.jp/whatistoc

MM (impact measurement and management) refers to a series of processes in which impact is identified, managed, and reported, and this cycle is used to make improvements.

Source: “Introduction to Impact Investing”, Nao Sudo, Nikkei Business Publication, 2021